The temptation to abandon a sinking Euro ship grows. China and other emerging countries move out already.

That such large costs might materialise as a result of the euro’s adoption has always been a foreseen and politically ignored, but only now are they being realised. In Euro and marginalization of European citizens by a deflation and recession. Thanks to the American counterexample, those cost are being realised and very, very visibly.

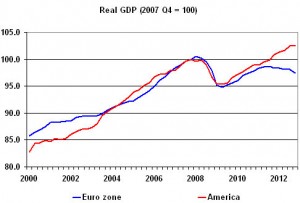

Similarly the gold standard was a powerful idea which delivered unquantifiable benefits and unquantifiable costs. The powerful fear of the unknown kept the gold standard intact even as the costs of Depression mounted. But once the dominoes began falling, they fell quickly. Even America, with enormous gold reserves and therefore, seemingly, a strong interest in maintaining the standard, only remained on gold for two more years after the system began to unravel in 1931. The threat that disaster might befall any euro member to drop out may continue to keep economies in line. The nightmare of th Eurocrates would be on Euro dropout doing well. But America represents a wild card that : a very large and very in-debt economy not on the troubled Euro and not suffering for it. The gap between the euro zone and America is the counterfactual, the but-for path, that helps illustrate just how damaging the single currency has been.

I had been surprised at how long euro-area residents seemed content to suffer through the continent’s economic mess. But maybe I shouldn’t have been; until recently, it wasn’t obvious that other large, rich economies could manage much better. Now it is, and it will become more obvious every quarter. The are suggestions to follow the Lira approach.

While I agree Europe is falling short of intellectual potential, I am a little puzzled about the suggestion European Central Bank refuses to give in to liquidationism and a little worried about Mario Draghi’s potential to do harm European’s on behalf of big international investors. After the EZB’s less than brilliant advising role in Cyprus banks are still on an ELA life line and capitalized by LH planes full of cash. Draghi very recently announced drastic EZB measures: I wonder what that might be after LTRO, ELA, Target II, OMT, SMP and low interest? Planes literally parachuting money? The Euro was a bad idea for everybody certainly for all Europeans – except a few Geckoes. If I remember well, the last banker dealing successfully with the Gold standard and Deflation was Hjalmar Schacht.